ROYAL Bafokeng Platinum (RBPlat) suffered a full-year headline loss of 83 cents per share – a 322 cents/share reversal in fortune compared to the 2014 financial year with low prices blamed for the loss.

The company, echoing the distress of Impala Platinum, also said it had instituted a back to basis safety strategy after losing five employees during the year. An investigation found that “… leadership, behavioural maturity and contractor management” needed to be addressed. The fatalities were ” a great concern,” it said.

In December, the Department of Mineral Resources issued an order – retracted a day later – that all platinum mining operations in the North West province be shut. Safety in South Africa’s platinum sector remains a concern to the government.

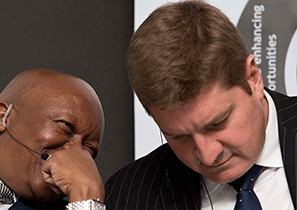

“We nullified almost everything we’ve done in safety,” said Steve Phiri, CEO of RBPlat in the company’s results presentation today. “None of these fatalities were unpreventable; all resulted from a breach of safety rules; making the wrong calls at critical moments when guidelines were there; as well as poor supervision,” Phiri said.

A programme of cultural-based safety initiatives, in addition to behavioural safety plans, would be implemented at the company’s Bafokeng Rasimone Platinum Mine and Styldrift operations.

Commenting on its 2015 loss-making performance, RBPlat said in notes to its published results that a 13% reduction in the average rand basket price had inflicted the lions’ share of damage to the company’s bottom line.

Some 144.2 cents/share of the negative tunaround (322 cents) was owing to the average rand basket price of R17,256 per platinum ounce. Interestingly, the group is budgeting for a average basket price of R17 500/Pt ounce in the current year – a slight improvement year-on-year despite the recent weakening of the rand to the dollar.

The company posted a pretax loss of R4.52bn (2014: 844.5m profit) which included impairments of R4.47bn.

Returning to the headline earnings level, some 57.5 cents of the reversal were attributable to the settlement of the tax dispute with SARS described previously totalling R50m in income tax and R60m in deferred tax. A further 90.6 cents of the share earnings loss was attributable to mining inflation increase in cash costs.

RBPlat said platinum prices would remain depressed for most of the year.

“We anticipate that platinum group metal (PGM) prices will remain at their currently depressed levels at least for the next 12 months,” the company said. South African supply of PGMs was the highest last year since 2013, it said.

During the 2015 financial year, RBPlat said it had slowed down development of its R10bn Styldrift I project. Billed as the company’s key organic growth project, some R1bn had been set aside for capital for the project in the current year.

Of this capital allocated, approximately R600m to R700m would be funded from cash flow generated by our BRPM operations and Styldrift on-reef development.

“We have the flexibility to pull back some of the infrastructure spend on the project should the average rand basket price reduce below our assumed level of R17 500/Pt ounce for a prolonged period,” it said.

“We expect the group after taking working capital requirements and the above assumptions into account, to end 2016 with a positive cash balance, with the likelihood that the R500m revolving credit facility secured in January 2016 will remain unutilised by end of 2016,” it added.