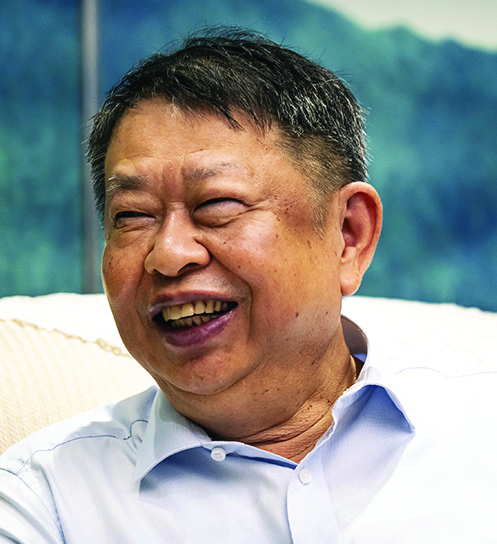

Tristan Pascall

CEO: First Quantum Minerals

‘We are open-minded in respect of potential partners’

2024 was a tough old year for Tristan Pascall’s First Quantum Minerals. The enforced closure of its Cobre Panamá mine in the previous year hit the company hard. Other than lost revenue – it represented 40% of the topline in 2023 – First Quantum also had to pay for idling costs at the mine. A sea-change, however, was the election of José Raúl Mulino as Panama’s new president in July. His administration has promptly ordered an audit of the mine. This could lead to a reopening although there’s no certainty on timelines. Pascall says it could take six months to restart the mine if reopened, with the task becoming more difficult with time as labour slowly drifts away.

These events in South America had big consequences for First Quantum’s Zambian mines. The speculation is Mitsui & Co, the Japanese firm, is leading bidding for up to 20% in the Sentinel and Kansanshi mines, potentially earning First Quantum $2bn and easing balance sheet pressure. Saudi Arabia’s state-aligned Manara Minerals Investment is said to be another potential bidder for the Zambian mines.

While First Quantum is yet to decisively signal its plans on this score, it’s clear the firm is under pressure to act. It was lossmaking through much of 2024, which drove net debt higher, and has $500m to spend completing the $1.25bn expansion of its S3 Kansanshi expansion. Pascall agreed to hedge 40 to 50% of First Quantum’s copper output for 2025, and last year signed a $500m copper prepayment deal for 50,000 tons over three years with China’s Jiangxi Copper.

LIFE OF TRISTAN

Pascall joined First Quantum in 2007 and held progressively senior roles in Africa and Latin America until he was appointed director of strategy in 2020. He became COO in 2021, and his appointment to the CEO role was announced in November following what the company termed a “thorough evaluation”, which included a “worldwide external search”.