[miningmx.com] – ANGLOGOLD Ashanti talked up the prospects of reopening its mothballed Ghana mine Obuasi saying the company had received “quite a lot of interest” from joint venture partners.

Srinivasan Venkatakrishnan, CEO of AngloGold, said at the group’s fourth quarter and full-year results presentation – in which it demonstrated further improvements in debt reduction and cost control – that he was confident Obuasi would attract a partner.

“I don’t want to speculate on the future but we are confident we can get a joint venture partner for the mine,” he said, adding that the company had received offers to purchase the mine outright “at various points in time”.

However, Venkatakrishnan emphasised the need for AngloGold to be “unemotional” regarding Obuasi which is beset with conflict owing to an invasion of the mine premises by hundreds of illegal miners.

Military personnel withdrew from the mine on February 2, a development that threatened the long-term viability of the mine, AngloGold said. On February 6, an AngloGold employee was killed during a riot.

“If allowed to continue unchecked, illegal mining taking place on parts of the concession, and vandalism of property could threaten the long-term viability of the mine,” AngloGold said on February 17.

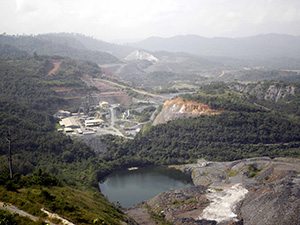

AngloGold placed Obuasi in mothballs last year followed an extended period of restructuring. It then resolved to find a joint venture partner with the purpose of recapitalising the 30 million oz operation into a smaller, profitable mine.

This was part of a self-help strategy imposed by AngloGold Ashanti to cut unprofitable gold production across its operations and reduce group debt.

Randgold Resources agreed with AngloGold that it would investigate the feasibility of entering into a joint venture agreement to redevelop the mine but it withdrew from a joint venture in December.

As part of a proposal to restore calm at the mine, AngloGold had relinquished two-thirds of the Obuasi concession the company does not need. Venkatakrishan said it was “up to the government” to make this available to artisanal mining activities.

“We view this as a tier one asset and it is leveraged to the gold price,” said Venkatakrishnan of the mine.

DEBT REDUCTION

AngloGold produced a strong fourth quarter in which free cash flow was $160m enabling it to end the 2015 financial year free cash positive to the tune of $141m compared to an outflow in the 2014 financial year of $112m.

Adjusted headline earnings for the year came in at $49m compared to loss of $1m the prior year.

“This achievement was all the more noteworthy given that it occurred despite the 8% drop in the gold price,” the company said in notes to its financial results. Net debt fell by 30% to $2.19bn from $3.13bn at the end of 2014, it said.

Production for the year was 3.94 million ounces – at top end of revised guidance range – although output fell in South Africa to just over one million oz from 1.22 million oz in 2014. The decline was due mainly to a combination of lower grades and safety-related disruptions during the year, the group said.

All-in sustaining costs were $910/oz, an 11% decline year-on-year.

For the current financial year, AngloGold has targeted output of up to 3.8 million oz, although Venkatakrishnan said the company was no longer forecasting “absolute numbers” allowing it the flexibility to cut unprofitable output.

However, AngloGold said it hoped to lift production from South Africa 10% with a concomitant 10% cut in all in sustaining costs. Roughly a third of AngloGold’s total gold production is derived from its South African operations.

Total group cash costs were estimated to be between $680/oz and $720/oz and all-in sustaining costs between $900/oz and $960/oz. An average exchange rates of R15 to the dollar has been forecast for the year.