THE March quarter is traditionally a difficult three months for South Africa’s gold companies to manage because it takes time to return to full productivity following the seasonal holidays.

This year, the quarter coincided with a stronger rand compared with the quarter of the previous year, a development that had a significant impact on industry cost performance.

The South African mines of AngloGold Ashanti recorded a significant leap in all-in sustaining costs (AISC) to $1,158 per ounce compared to $919/oz last year. This contributed towards a March quarter net cash outflow of $119m.

In the case of Sibanye Gold, AISC increased to $1,163/oz from $895/oz in the March quarter of 2016, although it remained cash flow positive even after capital expenditure associated with developing its Burnstone project.

But it was the ability of Harmony Gold to keep up with the pack that was most noteworthy. Its AISC increased 10% in dollar terms to $1,246/oz or 5% higher in rands to R529,409/kg reflecting the marginal nature of its assets.

However, it has gold and currency hedges that helped it to a free cash margin estimated by Standard Bank Group Securities at about 9% in the quarter compared to 7% at Gold Fields and 4% at each of Sibanye Gold and AngloGold Ashanti.

The gold hedge contributed a 28% premium to the average spot rand gold price for 20% of group production while the currency hedge could have contributed about R280m in other income, it said.

Taken out in June last year under the guidance of gold mining industry veteran, Frank Abbott, Harmony’s CFO, they were calculated in a note earlier this year by Deutsche Bank as worth R7/share.

Its analyst, Patrick Mann, said in a note this week that Harmony had some R1.8bn undiscounted value in its rand gold forward contracts – equal to 216,000 oz/year – whilst the currency hedge is worth R800m and locks in an average floor of R15,29 to the dollar covering $440m until the end of the 2017 calendar year.

Both banks agree, though, that Harmony’s ‘purple patch’ might be drawing to the end and the out-performance of the firm against its peers will be short-lived.

Not so short-lived, argued Marian van der Walt, head of investor relations for Harmony Gold. “The hedges will benefit us up to June 2019,” she said.

However, analysts worry certain operational issues such as the decision to invest $180m on Hidden Valley, a mine in Papua New Guinea in which Harmony now has 100% exposure, but which has a track-record of marginality.

“We have made good progress in terms of our re-investment plan and simply need to prove the sceptics wrong,” said van der Walt. Hidden Valley was also “cheap at the price” compared to other recent acquisitions. “We paid from our own cash flow and without diluting shareholders,” she said.

“We rate Harmony a sell,” said Mann. “There is no margin to speak of and we forecast a stronger rand to put the company under pressure. We also view risks related to the M&A strategy as skewed to the downside,” he said.

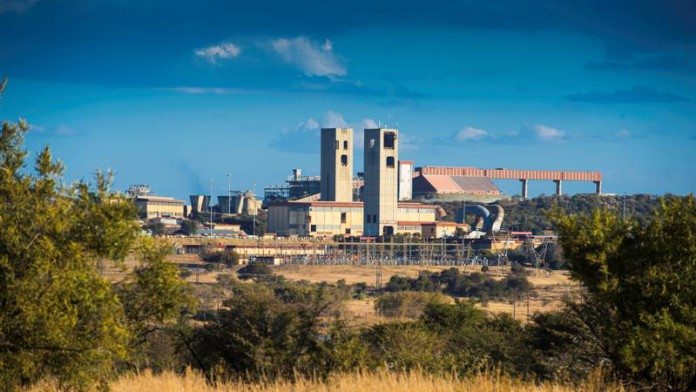

This is the plan announced by Harmony CEO, Peter Steenkamp, to take production to some 1.5 million ounces a year whilst simultaneously cutting high cost production, and the lives, of its marginal South African assets including Kusasalethu – a West Rand mine that has contributed heavily to production in the past.

The idea was to seek potential deals in sub-Saharan Africa, possibly two or three, yielding about 150,000 oz/year which would replace high cost South African output.

So far, Steenkamp has kept mum on progress saying there have been one or two areas of advanced talks, but nothing that has come to pass as yet.