AFTER more than three years of delay and uncertainty, Harmony Gold has put its Wafi Golpu copper/gold prospect in Papua New Guinea back on the road.

The company today announced the signing of a framework memorandum of understanding (MoU) with partner Newcrest Mining and the PNG which is a first step towards the grant of a Special Mining Lease (SML).

Once the SML is in place, Harmony can take Wafi Golpu to its board and then to shareholders. Before that, Harmony will update its 2018 feasibility study in which it estimated total project capital of $5.38bn, down $1bn from a study in 2016.

Average annual gold production was put at some 266,000 ounces and copper output of 161,000 tons compared to production previously estimated of 130,000 tons. The life of mine of the project was cut to 28 years in the 2018 study from 35 years previously.

Today’s MoU sets out the inputs that will be negotiated in a Mining Development Contract, including the term and scope of the Special Mining Lease, the PNG’s equity participation as well as royalties and the tax rate to be applied.

Helpfully, the MoU establishes Wafi Golpu as a project of national interest. This may add some impetus for government negotiations which have been stuck in the mire of political contestation for longer than most care to remember.

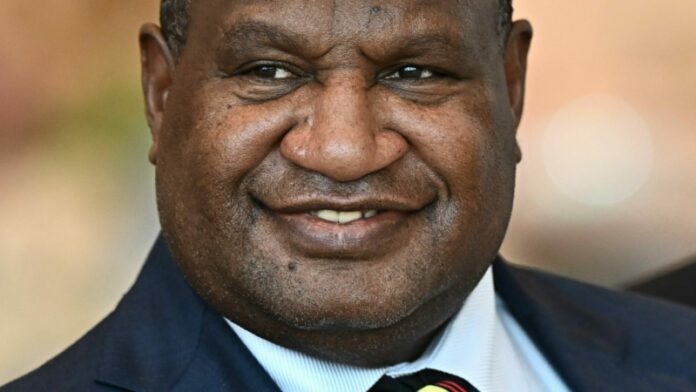

In 2020, a PNG court dismissed a stay order lodged by the then governor of Morobe province, where Wafi Golpu would be built, who claimed he should have been consulted on the MoU. After that, Wafi Golpu was sidelined amid political unrest in the PNG which included a period in which James Marape was re-elected prime minister of the country.

His campaign for re-election was fraught and violent as Marape fought off predecessor and former party leader Peter O’Neill’s attempts to seize back power.

“The principles agreed upon provide a basis for the equitable distribution of the benefits from this project to landowners, communities, the Morobe Provincial Government and the Independent State of Papua New Guinea while supporting meaningful returns for the developers and providers of capital,” said Peter Steenkamp, CEO of Harmony in a company statement.

Despite the forbidding capital stress Wafi Golpu would place on Harmony’s balance sheet, the prospect of its development adds a new level of interest to its business case, especially as it bids to diversify from its ageing South African production base.

In October, the company announced the $170m purchase of Eva, a copper/gold project in Australia (potentially increasing to $230m in royalty payments) which would cost an estimated $600m to build – a capital bill Harmony could reduce somewhat once it completes the optimisation of a feasibility study.

The Eva optimisation study, due to be completed by year-end, will compete for capital with the deepening of its Mponeng mine. Some R17bn in stay-in-business capital will be spent by Harmony Gold this and next year, a development that led to the passing of the firm’s interim dividend in February.