GLENCORE announced a $2.2bn top up in returns to shareholders despite producing sharply reduced year-on-year interim numbers in which lower mineral prices saw net profit fall 62% to $4.6bn.

“Our shareholder returns framework of managing net debt, in the ordinary course of business, around a $10bn cap, with deleveraging periodically returned to shareholders, informed today’s announcement of additional ‘top-up’ returns of $2.2bn,” said Gary Nagle, CEO of Glencore.

He added in a presentation to analysts that it was “easy to get caught up” in the interim numbers but they represented “record” second best first half figures.

The top up consists of an eight US cents per share special distribution ($1bn) and a share buyback equal to 10 US cents/share ($1.2bn). The top-up takes Glencore’s total announced shareholder returns this year to $9.3bn.

The top up also allows for $2bn in merger and acquisition activity and an increase in net debt to $1.5bn from neutral at the close of the 2022 financial year on December 31.

Morgan Stanley said the top-up was below expectations which it had put at $3.5bn. However, the bank said it expected Glencore to return the $2bn set aside for dealmaking if it did not transpire.

As demonstrated with other diversified mining companies, Glencore suffered the effects of a correction in metal prices as well as the added pressure of sharply corrected thermal coal prices, down between 36% (ex-Newcastle) and 53% (API4).

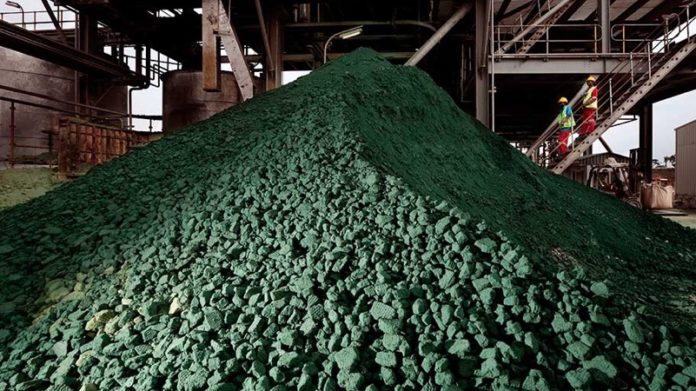

Cobalt price sank heaviest at some 59% and hurt Glencore’s African Copper assets as previously alerted in its second quarter production report last month.

Group adjusted earnings before interest, tax, depreciation and amortisation (Ebitda) fell 50% to $9.4bn compared to the first half of the firm’s 2022 financial year.

Glencore’s marketing division reported Ebit of $1.8bn, down 52% year-on-year. Nonetheless, the group said that for the year Ebit from marketing would come out at the top end of its $2.2bn to $3.2bn guidance range.