[miningmx.com] – RANDGOLD Resources is looking at making acquisitions given the current “volatile and very dynamic situation’ facing the gold industry, but CEO Mark Bristow reckons conditions will have to get worse before he sees deals worth doing.

He also believes that is exactly what is about to happen. “If I am fundamentally right on my numbers, then the gold industry cannot continue as it is at the moment. Just about everybody in the industry is bust and the financial stress regime they are facing is exponential in nature.

“Times are very tough. It’s tough enough for us and we are profitable. When you have three out of the five world major gold producers sitting with debt almost as great as their market capitalisations – or more – you have a real problem in the industry.

“When you look at their reserves, very few of these highly geared companies, be they large or medium, can actually repay their debt on their current reserve base. Plus all the mines in that situation are high-grading because they have to service this debt despite the fact that they are not making real profits.

“So the point is rapidly arriving where you are either going to see a complete melt-down or else a proper engagement must take place between the various stakeholders to get this thing back on an even keel.

“That means CEO’s have to tell the truth; secondly, governments need to catch a wake-up on the implications of failed mining industries; and thirdly the market has to lift its horizons on the objectives of fund managers.”

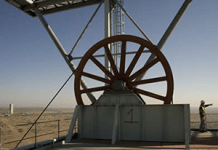

Bristow’s mantra until now has always been that it was better for Randgold to find its own projects rather than buy them. Randgold has grown into a 1 million ounce/year producer over the past 20 years with minimal corporate action.

It has gotten involved so far in only three bouts of merger and acquisition (M&A) activity. It bought the Siyama mine in Mali from BHP in the late Nineties; it bid unsuccessfully against AngloGold for Ghanian producer Ashanti in the mid-2000’s, and it took over junior Moto Gold Mines to get control of what is now the Kibali mine in the Democratic Republic of Congo.

Bristow commented: “Right now, I’m digging around seeing what’s what, but there are only about 15 assets in the world that meet our criteria and that defines our approach.

“Also, right now, everbody – to a man – is saying that the industry has to restructure but no-one has yet said that “I have to restructure’. Everyone is trying to sell the cow dung and that does not sort out the balance sheet problem.

“You have to get to the point where you sell what you “need’ to sell rather than what you would “like’ to sell.

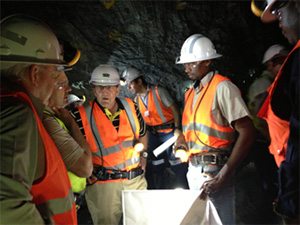

“We have had engagements with a number of companies. We did a number of pre-feasibilities over the past year, but the interesting thing for me in all of them – without exception – was that when we got on the ground what we found was not what was promised or presented by management.’

Bristow added: “That’s a challenge. The point must come when the market and management come to a point of honesty – I guess – and then things will happen. I have always said it is cheaper to find it rather than buy it, but dynamics brings opportunities. We are getting to a point where it may become cheaper to buy it but I am going to wait a bit longer.

“We do not want to buy screw-ups. We want to buy opportunities. Fixing our own screw-ups is difficult enough. Fixing somebody else’s screw-ups is hard.’

Randgold today reported results for the December quarter and year to end- December showing a 26% increase in gold production to 1.15 million ounces (financial 2013 – 0.92 million ounces), but a drop in annual attributable profit to $235m ($278.4m) because of the lower gold price.

A 20% increase in dividend to 60c (50c) has been proposed. As of end-December Randgold had no debt while cash on hand had more than doubled to $83m ($38m).