[miningmx.com] – KUMBA Iron Ore shares slipped 3% in trading on the Johannesburg Stock Exchange on Tuesday morning following the release of results for the year to end-December which revealed tumbling profits, a slashed dividend, and a revised operating plan which has reduced the remaining life of the Sishen mine by two years to 16 years.

The Kumba share price dropped to around R230 which is approximately half the level of R458 at which Kumba shares were trading this time last year.

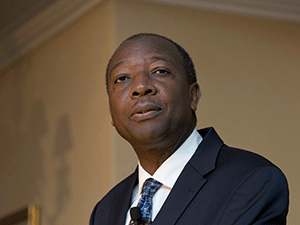

According to Kumba CEO, Norman Mbazima, the “single biggest factor’ for the poor results was the plunge in the export iron ore price which resulted in a 13% fall in revenue to R47.6 bn (2013: R54.5bn).

Operating profit fell 32% to R19.2bn (R28.4bn) while headline earnings were 29% down at R11bn (R15.4bn).

The total dividend was chopped to R23.3 a share (R40) as Kumba raised its dividend cover to 1.4 times (1.2 times).

Mbazima said average spot prices for iron ore dropped 28% last year, but pointed out the “average’ figure was misleading with iron ore prices dropping 47% from around $134/t at the beginning of 2014 to around $71.75 at the end after hitting a five-year low of $66.25 during December.

The outlook for 2015 is not good with Mbazima predicting no foreseeable rise in the iron ore price this year because of expected increases in supply from the major global iron ore producers combined with declining demand from major consumer China.

Mbazima said that the annual growth in Chinese crude steel production had slowed to 4.5% in 2014 from 6.5% in 2013 and was expected to slow down further to between 1.5% and 2% during 2015.

“We don’t see anything that could support a recovery in the iron ore price. If the iron ore price stays where it is now for the rest of the year then you will another substantial drop in our earnings, ” he said.

The extent of the fall in the iron price had overwhelmed various positive factors such as the premium paid for Kumba’s lumpy, higher-grade ore; increased export levels which were 4% up at 40.5mt and the sharp drop in seaborne freight rates.

Mbazima said Kumba had responded to the situation with a number of measures including cutting “near-term project capital expenditure’ by 40%, retrenching up to 150 head office staff – about 40% of the total head office complement – and revising the stripping ratio at Sishen which had increased the value of the mine but shortened its life by two years.

He said Kumba had also suspended the low grade mining project at the Thabazimbi mine and was looking at options for its future which include selling or mothballing the operation.